cryptocurrency news predictions

Cryptocurrency news predictions

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. https://bluepixel-prod.com/vector-and-bitmap-images/ This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App. It is not intended to offer access to any of such products and services. You may obtain access to such products and services on the Crypto.com App.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

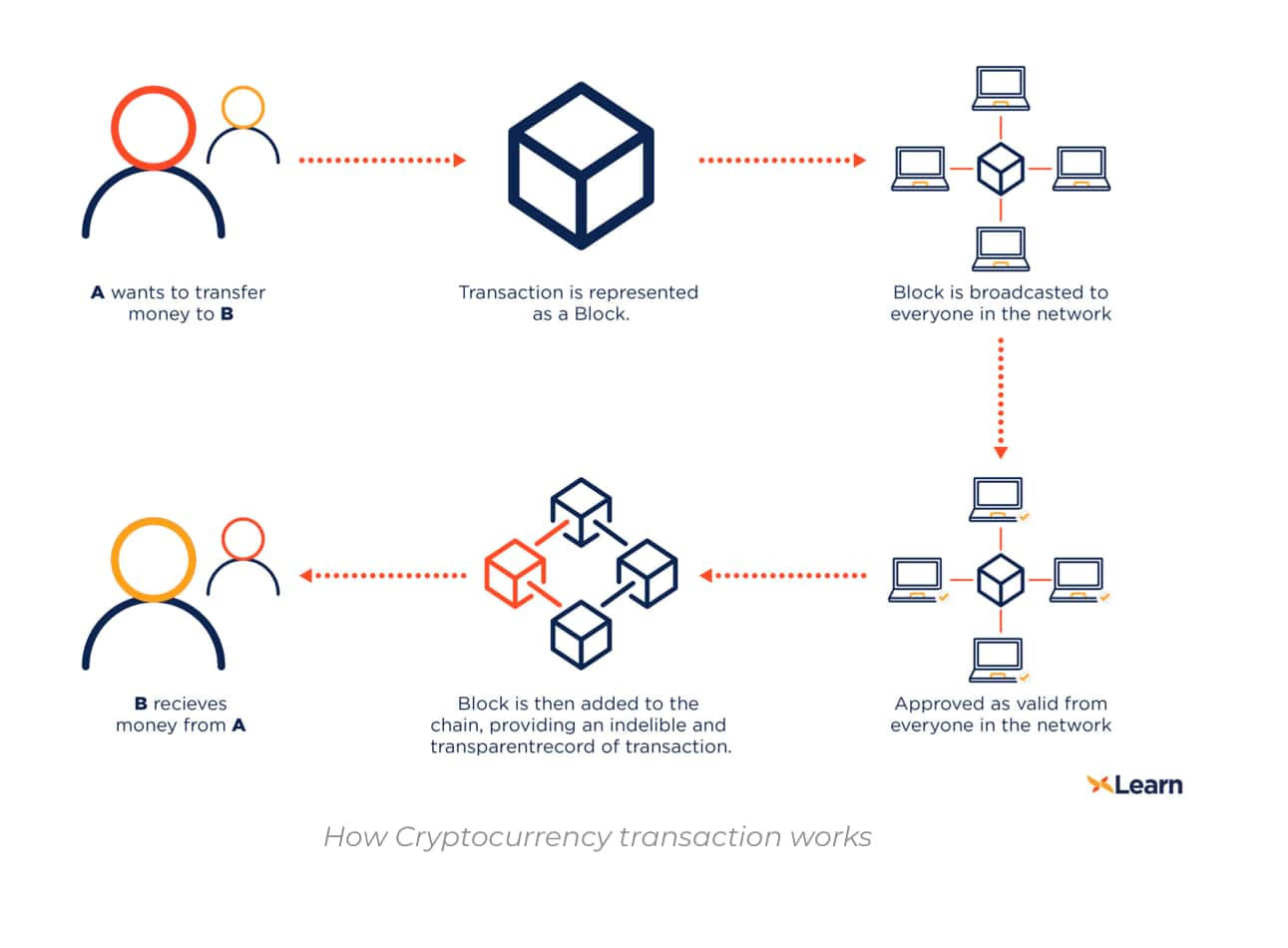

How does cryptocurrency work

TIP: Like anything else in life, there are tax implications to trading or using cryptocurrency. Make sure you understand the tax implications. In short, you’ll owe money on profits (capital gains) and may owe sales tax or other taxes when applicable. Learn more about cryptocurrency and taxes.

TIP: Like anything else in life, there are tax implications to trading or using cryptocurrency. Make sure you understand the tax implications. In short, you’ll owe money on profits (capital gains) and may owe sales tax or other taxes when applicable. Learn more about cryptocurrency and taxes.

The content of this website is provided for informational purposes only and can’t be used as investment advice, legal advice, tax advice, medical advice, advice on operating heavy machinery, etc. Our site is not officially associated with any brand or government entity. Any mention of a brand or other trademarked entity is for the purposes of education, entertainment, or parody. Neither CryptocurrencyFacts.com nor its parent companies accept responsibility for any loss, damage, or inconvenience caused as a result of reliance on information published on or linked to from CryptocurrencyFacts.com. In other words, this is a website on the internet offering free information about cryptocurrency. This is not your accountant, lawyer, or fiduciary offering you professional tax, legal, or investment advice. See our about page, legal and privacy page, and cookie policy for more disclaimers and information. ₿♦️🦄 🐕 🪨

Because there are so many cryptocurrencies on the market, it’s important to understand the types. Knowing whether the coin you’re looking at has a purpose can help you decide whether it is worth investing in—a cryptocurrency with a purpose is likely to be less risky than one that doesn’t have a use.

The word “crypto” in cryptocurrency refers to the special system of encrypting and decrypting information – known as cryptography – which is used to secure all transactions sent between users. Cryptography plays a vitally important role in allowing users to freely transact tokens and coins between one another without the need for an intermediary like a bank to keep track of each person’s balance and ensure the network remains secure.

In 2008, a group of people (currently known under the pseudonym Satoshi Nakamoto) created the guiding principles of the first and leading cryptocurrency in the market today, Bitcoin. In 2009, Bitcoin was launched to the world. But it would be years before it was formally recognized as a means of payment among leading merchants, starting with WordPress in 2012.

Cryptocurrency market

Multisig is kort voor ‘multisignature’ (meerdere handtekeningen) en verwijst naar een soort digitale handtekeningtechnologie waarbij het mogelijk is om een transactie digitaal te ondertekenen door twee of meer gebruikers.

Om een lang verhaal kort te maken, laat de hashsnelheid ons weten hoeveel rekenkracht Bitcoin-miners bereid zijn om te besteden aan het verwerken van transactieblokken. Des te hoger het hashingniveau is, des te veiliger de blockchain is.

Hardware Wallet: een nadeel van een online blockchain wallet is het risico dat je BTC kan worden gestolen als deze wordt opgeslagen in een zogenaamde “hot wallet” die is verbonden met het internet. Een hardware wallet betekent dat je munten worden versleuteld en opgeslagen op een fysiek apparaat, offline en in koude opslag. Veel van deze producten ondersteunen ook andere cryptocurrencies, waaronder Ethereum.

Bitcointransacties kunnen niet worden geannuleerd of teruggedraaid, vergelijkbaar met een bankoverschrijving, wat betekent dat het ontzettend belangrijk is om het adresformaat dubbel en driemaal te controleren voordat de transactie wordt uitgevoerd.

Cryptocurrency bitcoin

Over the past few decades, consumers have become more curious about their energy consumption and personal effects on climate change. When news stories started swirling regarding the possible negative effects of Bitcoin’s energy consumption, many became concerned about Bitcoin and criticized this energy usage. A report found that each Bitcoin transaction takes 1,173 KW hours of electricity, which can “power the typical American home for six weeks.” Another report calculates that the energy required by Bitcoin annually is more than the annual hourly energy usage of Finland, a country with a population of 5.5 million.

Hardware Wallet: een nadeel van een online blockchain wallet is het risico dat je BTC kan worden gestolen als deze wordt opgeslagen in een zogenaamde “hot wallet” die is verbonden met het internet. Een hardware wallet betekent dat je munten worden versleuteld en opgeslagen op een fysiek apparaat, offline en in koude opslag. Veel van deze producten ondersteunen ook andere cryptocurrencies, waaronder Ethereum.

Mempool-Transaktionen werden regelmäßig verarbeitet, jedes Mal, wenn ein neuer Block zur Blockchain hinzugefügt wird. Ausstehende Transaktionen, die in Mempools warten, werden erst dann freigegeben (verarbeitet), wenn sie den Mindestschwellenwert für die Transaktionsgebühr erreicht haben.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

Leave a Reply